We’re living in exciting times. Quantum computing is no longer just a futuristic concept; it’s starting to emerge as a game-changer for industries around the world. In finance, in particular, this technology promises to shake things up in ways we’ve only begun to imagine. While today’s markets depend heavily on algorithms, data crunching, and lightning-fast trades, quantum computers will push those limits even further – opening doors to smarter decisions, faster insights, and new possibilities.

Think about risk analysis and portfolio management – the backbone of what financial firms do every day. Right now, crunching all the possible outcomes for investments or market changes can take a lot of time and computational power. Quantum computers, with their unique ability to handle multiple calculations at once, could change that. They might allow us to evaluate risks and optimize investment portfolios almost instantly, giving firms a real-time edge in unpredictable markets. This could lead to more confident decisions, even when market conditions are volatile or uncertain.

Rethinking Derivatives Pricing and Market Simulations

Pricing complex derivatives and simulating market behaviour are among the most challenging tasks in finance. Today, these processes involve approximations and heavy computing resources, which can sometimes lead to inaccuracies. Quantum computing could dramatically improve this. It has the potential to perform these calculations with much higher precision and speed, giving traders and analysts a clearer picture of market risks. Better simulations could also help us understand how markets might react under extreme conditions—helping to prevent crises before they happen.

Video to embed here: Quantum Computing in Finance (high-level overview)

Strengthening Security and Combating Fraud

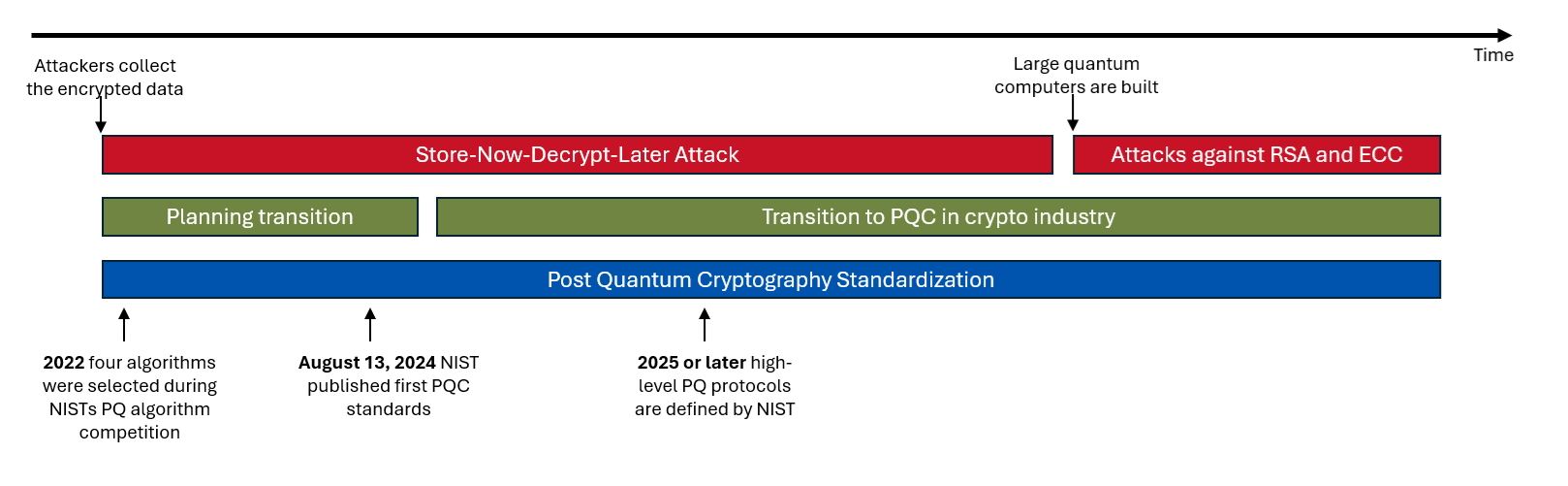

Security is always a top concern – especially with more transactions happening online every day. Quantum computing could help by analysing huge amounts of data quickly, catching patterns that might indicate fraud or suspicious activity. But there’s a flip side: quantum tech could also threaten current encryption methods, making some of today’s security measures vulnerable and completely obsolete. That’s why the financial industry is already racing to develop quantum-resistant encryption so that financial data remains safe in the future.

( Be Ready for Post-Quantum Security with Intel® Cryptography Primitives Library, https://www.intel.com/content/www/us/en/developer/articles/technical/post-quantum-cryptography.html)

A Glimpse of What’s to Come

As quantum technology advances and becomes more affordable, it could even the playing field. Smaller firms and individual investors might gain access to powerful tools that were previously only available to big banks or hedge funds. This democratization could spark more innovation and competition across the industry, benefiting everyone. Of course, this is not all smooth sailing. Quantum hardware is still in its early stages, and there are hurdles to overcome – like making qubits more stable and scalable.

A qubit, or quantum bit, is the fundamental unit of quantum information. Unlike classical bits that can be either 0 or 1, a qubit can exist in a superposition of both states simultaneously, thanks to the principles of quantum mechanics. This property enables quantum computers to perform complex calculations more efficiently than classical computers for certain tasks. Qubits are typically implemented using particles like electrons or photons, which can be manipulated to harness quantum phenomena such as entanglement and superposition.

Plus, with such powerful technology comes responsibility. We’ll need to think carefully about ethical concerns – like market manipulation, data privacy, and systemic risks—and ensure we develop and use this technology responsibly.

Looking forward, it’s clear that quantum computing has enormous potential to transform finance. Major banks, tech companies, and startups are investing heavily to explore this frontier. Over the next few decades, quantum technology could become an essential part of how we trade, manage risks, and protect our financial systems.

In the foreseeable future, quantum computing could lead to a smarter, more efficient, and more secure financial world – one where innovation thrives, and opportunities are more accessible than ever before. While challenges remain, the future looks promising, and the possibilities are truly fascinating.

Videos to embed:

New quantum computers – Potential and pitfalls | DW Documentary

Video: Quantum Computing in Finance